Tetious Dimensions Is Introducing a New Product

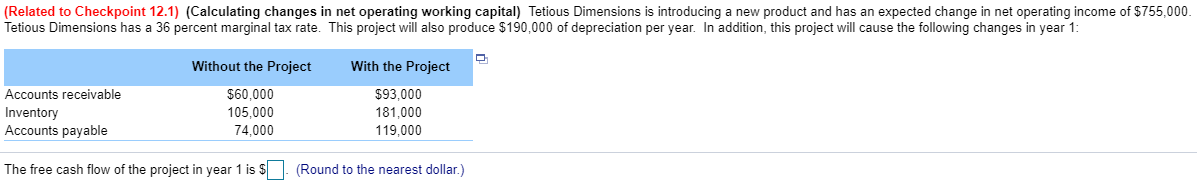

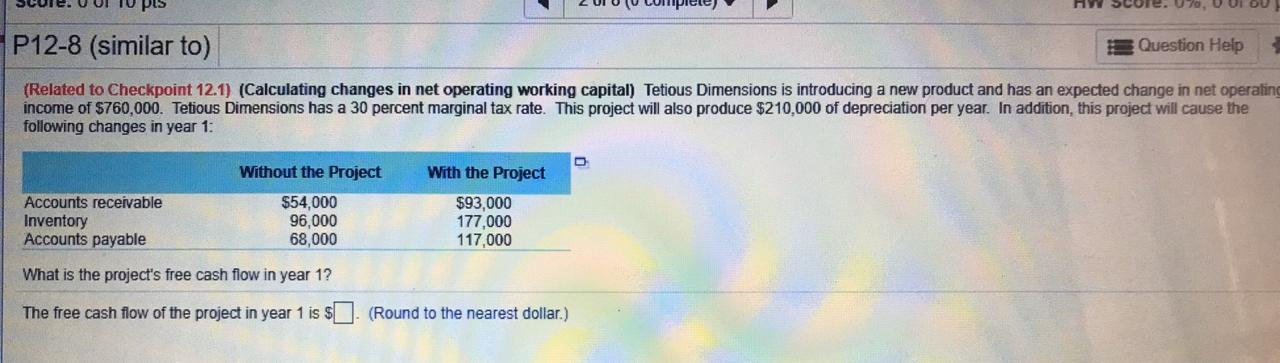

Without the Project With the Project. Tetious Dimensions is introducing a new product that is expected to increase its net operating income by 775000.

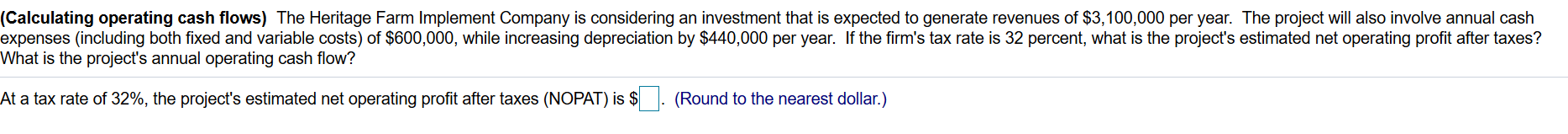

Analyzing Project Cash Flow Abshor Marantika Abilio Christofory Fani

Tetious Dimensions is introducing a new product that is expected to increase Tetious Dimensions is introducing a new product that is expected to increase its net operating income by 775000.

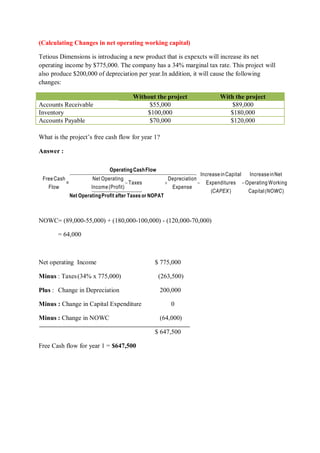

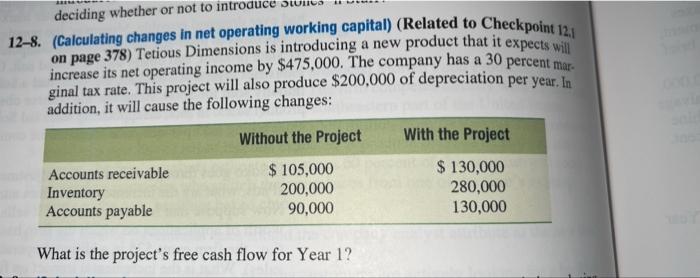

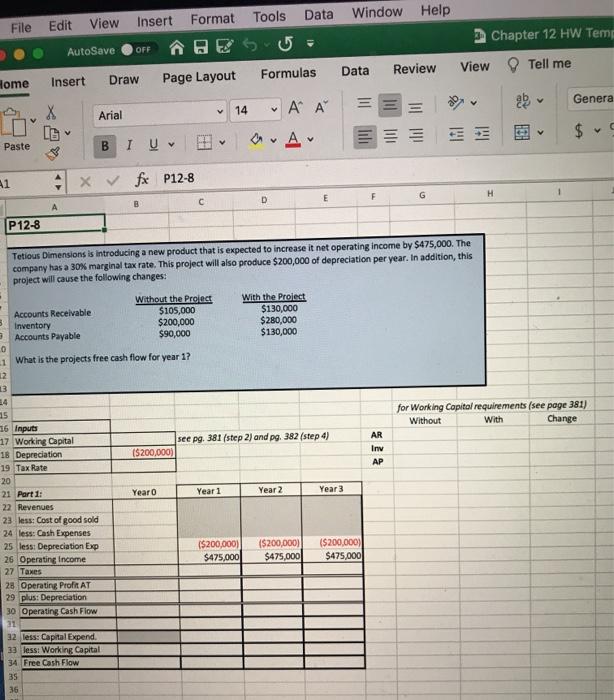

. In addition this project will cause the following changes in year 1. This project will also produce 200000 of depreciation per year. This project will also produce 185000 of depreciation per year.

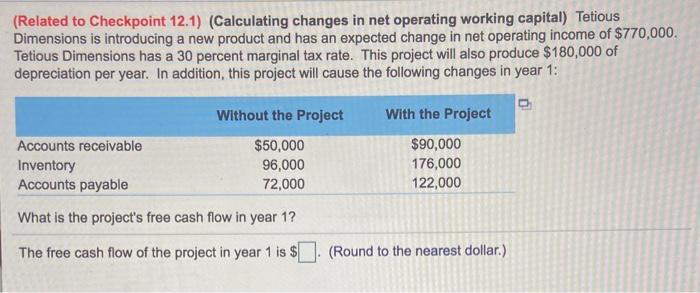

Tetious Dimensions has a 34 percent marginal tax rate. Racinâ Scooters is introducing a new product and has an expected change in net operating income of 475000. Tetious Dimensions has a 30 percent marginal tax rate.

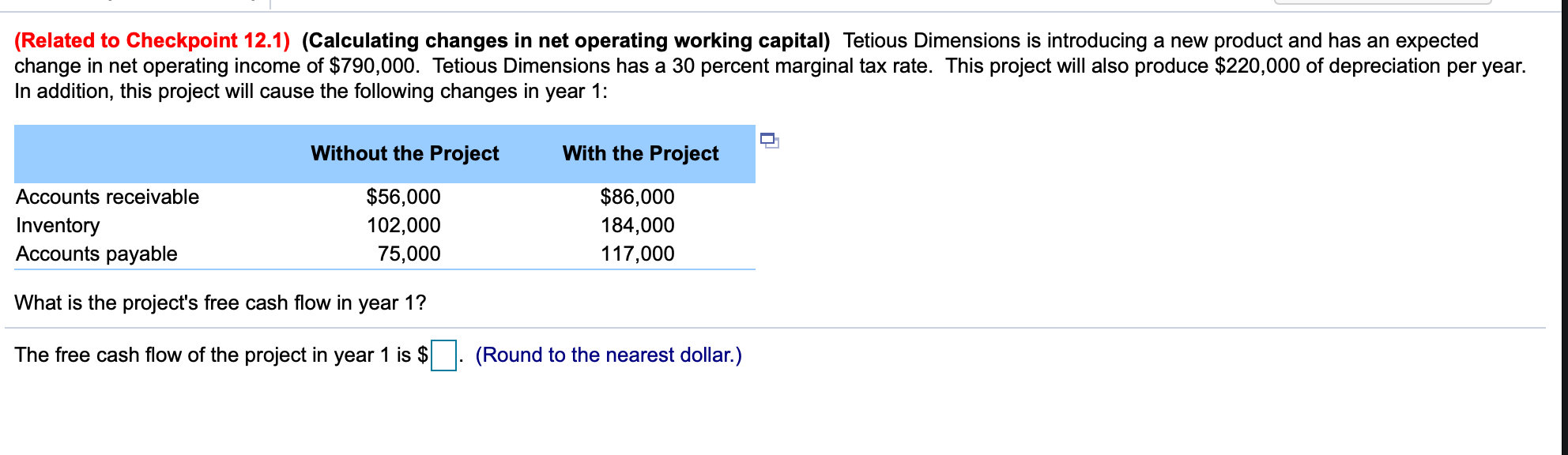

Tetious Dimensions has a 34 percent marginal tax rate. 25 million 80 20000000. This project will also produce 220000 of depreciation per year.

This project will also produce 200000 of depreciation per year. Without the Project With the Project. Chapter 12 exercises - u00a3104 12u20141 12-2 12u20143 124 12u20145 PART 3 i Elan-tEH-iltrln1Determining relevant cash flows Captainu2018s Cereal is.

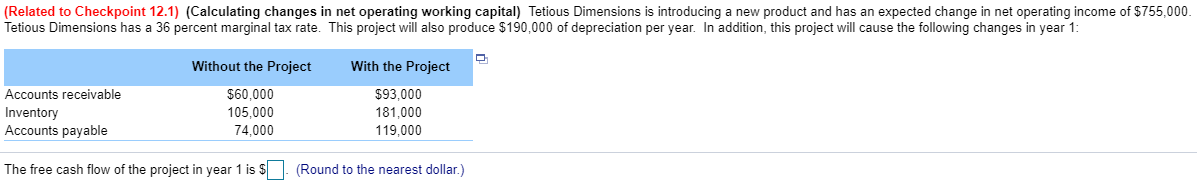

In addition this project will cause the following changes. Tetious Dimensions is introducing a new product and has an expected change in net operating income of 755000 Tetious Dimensions has a 31 percent marginal tax rate. Tedious Dimensions has a 34 percent marginal tax rate.

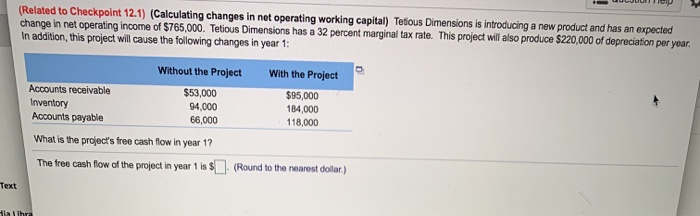

Tetious Dimensions is introducing a new product that is expected to increase it net operating income by 475000. In addition this project will cause the following changes. Tetious Dimensions has a 32 percent marginal tax rate.

Tetious Dimensions has a 32 percent marginal tax rate. This project will also produce 50000 of depreciation per year. Tetious Dimensions is introducing a new product that is expected What is.

Tetious Dimensions has a 34 Q. Tetious Dimensions is introducing a new product that is expected to increase Tetious Dimensions is introducing a new product that is expected to increase its net operating income by 775000. Tetious Dimensions has a 34 percent marginal tax rate.

In addition this project will cause the following changes in year 1. Tetious Dimensions is introducing a new product that is expected to increase it net operating income by 475000. Tetious Dimensions is introducing a new product that is expected.

Duncan Motors is introducing a new product that it expects will increase its net operating income by 300000. Tetious Dimensions is introducing a new product that is expected to increase its net operating income by 775000. Tetious Dimensions is introducing a new product and has an expected change in net operating income of 750000.

This project will also produce 200000 of depreciation per year. In addition this project will cause the following changes in year 1. Calculating changes in net operating working capital Tetious Dimensions is introducing a new product and has an expected change in net operating income of 780000.

Without the Project With the. This project will also produce 220000 of depreciation per year. Capital Tetious Dimensions is introducing a new product and has an expected change in net operating income of 785000.

This project will also produce 200000 of depreciation per year. Racinâ Scooters has a 34. Duncan Motors has a 34 percent marginal tax rate.

Tetious Dimensions has a 21 marginal tax rate. The company has a 30 marginal tax rate. This project will also produce 200000 of depreciation per year.

Tetious Dimensions has a 30 percent marginal tax rate. This project will also produce 200000 of depreciation per year. FG133056642 Calculating changes in net operating working.

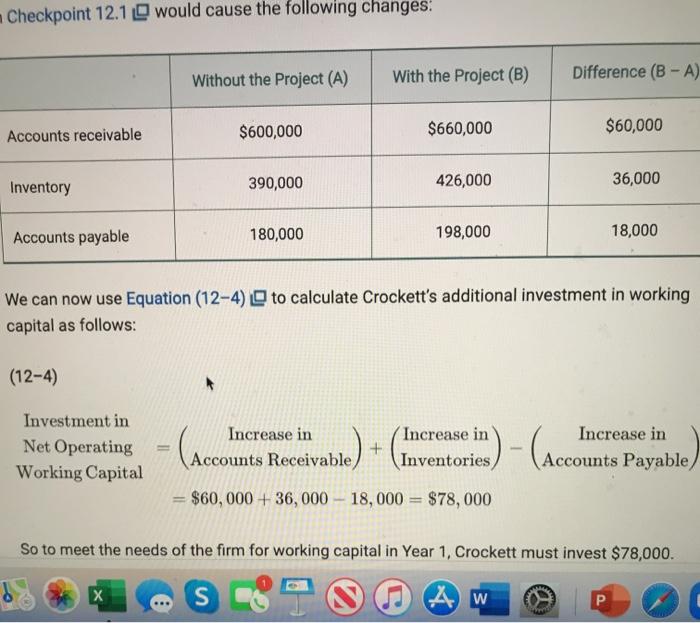

Related to Checkpoint 121 Calculating changes in net operating working capital Tetious Dimensions is introducing a new product and has an expected change in net operating income of 765000. Tetious Dimensions has a 34 percent marginal tax rate. Without the Project With the Project.

This project will also produce 200000 of depreciation per year. Tetious Dimensions is introducing a new product and has an expected change in net operating income of 750000. Tetious Dimensions is introducing a new product that is expected to increase its net operating income by 775000.

Duncan Motors has a 34 percent Q. Calculating changes in net operating working capital Duncan Motors is introducing a new product and has an expected change in net operating income of 300000. In addition this project will cause the following changes.

Tetious Dimensions has a 33 percent marginal tax rate. Tetious Dimensions is introducing a new product that is expected to increase it net operating income by 775000. This project will also produce 200000 of depreciation per year.

Tetious Dimensions has a 34 percent marginal tax rate. This project will also produce 205000 of depreciation per year. Tetious Dimensions is introducing a new product that is expected to increase its net operating income by 775000.

The company has a 30 marginal tax rate. This project will also produce 200000 of depreciation per year. This project will also produce 215000 of depreciation per year.

This project will also produce 200000 of depreciation per year. Calculating changes in net operating working capital Tetious Dimensions is introducing a new product and has an expected change in net operating income of 775000. Tetious Dimensions has a 34 percent marginal tax rate.

Solved Related To Checkpoint 12 1 Calculating Changes In Chegg Com

Related To Checkpoint 12 1 Calculating Changes In Net Operating Working Capital Tetious Dimensions Is Introduc Homeworklib

Solved Tools Data Window Help File Edit View Insert Format Chegg Com

Analyzing Project Cash Flow Abshor Marantika Abilio Christofory Fani

7 Product Dimensions From Our Discover To Deliver Now Can Be Downloaded Via Discovertodeliver Com Site Business Analysis Agile Interactive Design

Solved Related To Checkpoint 12 1 Calculating Changes In Chegg Com

Solved Related To Checkpoint 12 1 Calculating Changes In Chegg Com

2021 Fluted Panel Wall Panels Bedroom Modern Bedroom Interior Bedroom Panel

Solved Related To Checkpoint 12 1 Calculating Changes In Chegg Com

Reto Ultra Wide Slim Charcoal 35mm Film Camera In 2022 Film Camera 35mm Film Point And Shoot Camera

Enhypen Repackage Album Dimension Answer In 2022 Photo Book Photo Bookmarks Album

Analyzing Project Cash Flow Abshor Marantika Abilio Christofory Fani

Related To Checkpoint 12 1 Calculating Changes In Net Operating Working Capital Tetious Dimensions Is Introduc Homeworklib

Solved Related To Checkpoint 12 1 Calculating Changes In Chegg Com

Solved Score Uultu Pis 2 Ulu U Lomplete Hw Score U7 Uiou Chegg Com

Solved Can Yoj Please Show Me How To Do This In Excel The Chegg Com

Related To Checkpoint 12 1 Calculating Changes In Net Operating Working Capital Tetious Dimensions Is Introduc Homeworklib

Enhypen Repackage Album Dimension Answer In 2022 Instant Photos Album Photo Bookmarks

Solved Tools Data Window Help File Edit View Insert Format Chegg Com

Comments

Post a Comment